Robust report and moderate forecast: AMD reports better than expected, but risks remain

AI remains the key driver of AMD’s revenue growth, but trade restrictions complicate operations and increase costs. Against this backdrop, the company’s stock may experience a continued corrective decline.

Investors reacted cautiously as optimism around the AI segment was tempered by news of an 800 million USD inventory write-down caused by new US export restrictions. Nonetheless, AMD shares trended upward the day following the report release.

This article explores AMD, its revenue breakdown, and its product offerings in the AI market. It provides a fundamental analysis of AMD and a technical analysis of Advanced Micro Devices stock, forming the basis for the AMD stock forecast.

About Advanced Micro Devices, Inc.

Advanced Micro Devices, Inc. (AMD) is a US-based company founded in 1969 by Jerry Sanders and a group of fellow engineers. It designs and manufactures semiconductor devices, including processors, graphics chips, and server solutions. The company went public with an IPO on the NYSE in 1972 under the ticker AMD.

AMD is present in the rapidly expanding AI market with the following products:

- Graphics Processing Units (GPUs) for data centres: AMD produces Radeon Instinct microprocessors and has recently introduced new models in the MI series designed for high-performance computing and AI workloads. For example, the MI300 is a high-powered processor optimised for deep data analysis and large AI models

- Radeon Open Compute (ROCm) software: AMD has developed an open-source software platform, ROCm, providing tools for AI development and high-performance computing on the company’s GPUs

- Field-Programmable Gate Arrays (FPGAs): following the acquisition of Xilinx, AMD expanded into FPGAs, which are widely used for AI applications, including signal processing and adaptive computing

- Central Processing Units (CPUs): AMD also optimises its EPYC series processors to support AI computing in server solutions

- Products for end devices: in addition to server solutions, AMD develops specialised GPUs and FPGAs for AI-powered end devices, such as autonomous vehicles, smart cameras, and medical equipment

Advanced Micro Devices, Inc.’s main revenue streams

AMD’s revenue is generated from four key segments:

- Data Center: includes EPYC server processors, AMD Instinct graphics accelerators for AI and scientific computing, and Xilinx FPGA solutions for specialised workloads in data centres.

- Client segment: includes Ryzen and Athlon processors for desktop PCs and laptops, delivering high performance for general users and enthusiasts, and integrated graphics solutions for hybrid devices.

- Gaming segment: includes Radeon GPUs for gaming PCs, integrated solutions for gaming laptops, and custom processors for gaming consoles such as PlayStation and Xbox.

- Embedded segment: covers high-performance processors and graphics solutions for embedded systems in automotive electronics, industrial automation, medical devices, and telecommunications.

Advantages of Advanced Micro Devices, Inc. in the semiconductor market

AMD has several strengths that enable it to compete effectively with key industry players such as Intel Corp. (NASDAQ: INTC) and NVIDIA Corp. (NASDAQ: NVDA). The company’s main advantages are outlined below:

- Processor architecture: AMD introduced the Zen architecture, which significantly enhanced performance and energy efficiency. The Ryzen (consumer) and EPYC (server) series have gained popularity thanks to their excellent performance-to-price ratio. In recent years, AMD has surpassed Intel in terms of core and thread counts in processors

- Multi-core and multi-threaded solutions: AMD typically offers more cores and threads at the same price point, making its processors attractive to users requiring multitasking and high-performance computing (for example, for graphics, video editing, data streaming, etc.)

- Innovations in graphics technology: although AMD lags behind NVIDIA in some high-performance GPU functionalities, it maintains a strong position due to processors with high data processing throughput, offering a competitive price-to-performance advantage. With the RDNA and RDNA 2 series, AMD has significantly improved the energy efficiency and performance of its graphics cards

- EPYC server solutions: AMD’s EPYC line delivers an impressive performance-to-price ratio in the server segment, gaining traction among large corporations and data centres. These processors support more core counts per socket, reducing scaling costs for server infrastructure

- CPU and GPU integration: AMD manufactures both processors and graphics chips, allowing it to develop integrated solutions for laptops and gaming consoles. For example, AMD supplies processors for PlayStation and Xbox consoles, which ensures a stable revenue stream and reinforces its market presence

- Competitive pricing: AMD frequently offers lower-priced alternatives to Intel and NVIDIA, making its products attractive to a broader customer base, from enthusiasts to corporate clients

- the rapid adoption of new technological processes: AMD collaborates with TSMC to swiftly implement advanced process nodes (such as 7 and 5 nm), enhancing energy efficiency and performance across its processors and graphics chips

Advanced Micro Devices, Inc. Q3 2024 report

AMD released its Q3 2024 earnings report on 29 October, confirming continued revenue and net income growth. Below are the report’s key figures:

- Revenue: 6.82 billion USD (+18%)

- Net income: 0.77 billion USD (+158%)

- Earnings per share: 0.47 USD (+161%)

- Operating profit: 0.72 billion USD (+223%)

Revenue by segment:

- Data Center: 3.55 billion USD (+122%)

- Client segment: 1.88 billion USD (+29%)

- Gaming segment: 462 million USD (-69%)

- Embedded segment: 927 million USD (-25%)

AMD benefitted substantially from AI advancements, reflected in its Data Center segment, where revenue surged by 122%, contributing 52% of total revenue. The Gaming segment suffered the steepest decline (-69%), making it its weakest performer.

For Q4 2024, AMD projected revenue in the range of 7.20-7.80 billion USD, with an average estimate of 7.50 billion. This implied a 22% year-on-year increase and a 10% rise compared to Q3 2024. However, the forecast fell slightly short of analysts’ expectations, sparking investor concerns, particularly amid intensifying AI market competition and a broader slowdown in segment growth.

Advanced Micro Devices, Inc. Q4 2024 report

AMD released its Q4 2024 earnings report on 4 February, showing a 37% decline in net income. The report highlights are outlined below:

- Revenue: 7.65 billion USD (+24%)

- Net income: 0.48 billion USD (-37%)

- Earnings per share: 0.29 USD (+29%)

- Operating profit: 0.87 billion USD (+155%)

Revenue by segment:

- Data Center: 3.86 billion USD (+69%)

- Client segment: 2.31 billion USD (+58%)

- Gaming segment: 563 million USD (-59%)

- Embedded segment: 923 million USD (-13%)

2024 financial performance:

- Revenue: 25.78 billion USD (+14%)

- Net income: 1.64 billion USD (+92%)

- Earnings per share: 1.00 USD (+88%)

- Operating profit: 1.90 billion USD (+375%)

In Q4 2024, AMD CEO Lisa Su highlighted the company’s impressive performance, reporting a record annual revenue of 25.80 billion USD, up 14% from the previous year. This growth was mainly driven by a 94% surge in its Data Center revenue and a 52% increase in the Client segment. Su also emphasised that AMD prioritises total revenue rather than the number of processors shipped, particularly amid concerns about potential CPU oversupply in the PC market.

The company attributed the decline in Q4 net income to a 17% rise in operating costs, primarily due to higher research and development investments, especially in AI. Additionally, despite strong Data Center growth, AI GPU sales fell short of expectations, further impacting profitability.

For Q1 2025, AMD expects revenue of 7.10 billion USD, slightly exceeding analysts’ projections. However, Su warned about a potential AMD Data Center sales slowdown, citing heightened competition, particularly from NVIDIA (NASDAQ: NVDA) in the AI processor market.

AMD management remains optimistic about 2025. Su projects strong double-digit growth in both revenue and EPS for the year. She also highlighted the long-term potential of AMD’s Data Center AI business, which generated over 5.00 billion USD in 2024 and is expected to eventually drive annual segment revenue into the tens of billions of dollars.

AMD management’s sentiment was cautiously optimistic, focusing on leveraging the company’s strengths in AI and computing to drive future growth while remaining agile in response to market shifts in weaker segments.

Advanced Micro Devices, Inc. Q1 2025 report

AMD released its Q1 2025 report on 6 May. Below are its highlights compared to the corresponding period in 2024:

- Revenue: 7.44 billion USD (+36%)

- Net income: 0.71 billion USD (+476%)

- Earnings per share: 0.44 USD (+529%)

- Operating profit: 0.81 billion USD (+2,139%)

Revenue by segment:

- Data Center: 3.67 billion USD (+57%)

- Client segment: 2.29 billion USD (+68%)

- Gaming segment: 647 million USD (-30%)

- Embedded segment: 823 million USD (-3%)

AMD’s Q1 2025 financial performance strengthened confidence in the company as one of the leaders in the AI and data centre segment. AMD exceeded Wall Street expectations, reporting a 36% revenue increase and a 476% rise in net income. Meanwhile, the key segments showed even stronger growth. The data centre segment increased sales by 57%, while PC processor revenue rose by 68%, driven by sustained demand for EPYC server processors, Instinct accelerators, and Ryzen chips for consumer PCs.

For Q2 2025, AMD management projects revenue to range between 7.1 and 7.7 billion USD but cautions about potential losses of about 800 million USD as the company may postpone or entirely abandon the sales of a significant amount of its AI chips in China. The reason is the new export restrictions imposed by the US government, which ban advanced technology exports to the Chinese market. As a result, these chips cannot be sold, and their cost will likely be written off as losses. However, AMD management warned about this as early as 16 April, so this information is most likely already factored into the current stock price. For 2025, CFO Jean Hu estimates revenue losses of 1.5 billion USD due to export restrictions.

Nevertheless, AMD management remains optimistic about 2025. The company anticipates double-digit growth in both revenue and EPS for the year, driven by its expanding AI portfolio and strategic partnerships. This signals that AMD’s long-term potential remains promising despite external risks and short-term stock volatility.

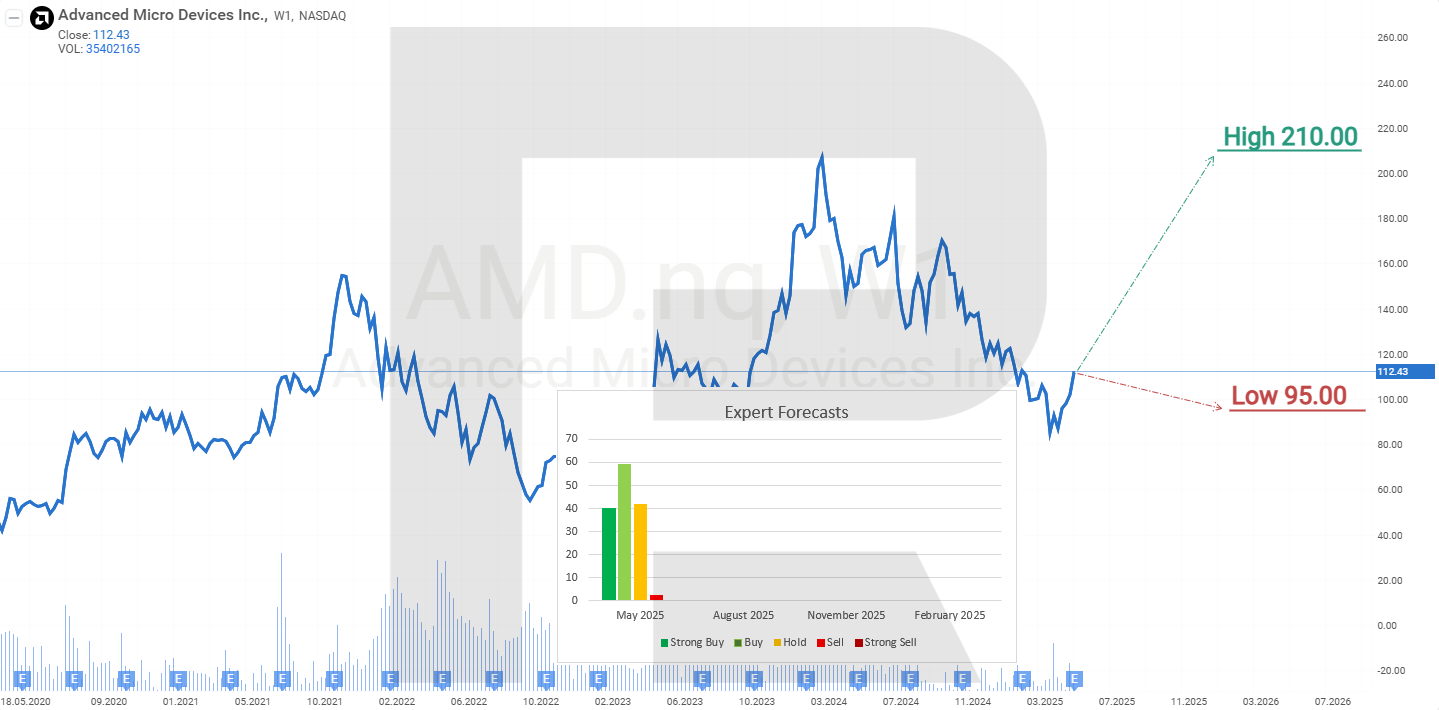

Expert forecasts for Advanced Micro Devices, Inc.’s stock

- Barchart: 29 of 42 analysts rated the stock as Strong Buy, one as Moderate Buy, and 12 as Hold, with a high target price of 200 USD

- MarketBeat: 24 of 35 specialists assigned a Buy rating to the shares, 10 recommended Hold, and one advised Sell, with a high target price of 200 USD and a low target price of 95 USD

- TipRanks: 22 of 31 analysts recommended the stock as Buy, and nine as Hold, with a high target price of 220 USD

- Stock Analysis: 11 of 35 experts rated the stock as Strong Buy, 12 as Buy, 11 as Hold, and one as Sell, with a high target price target of 210 USD and a low target price of 95 USD

Advanced Micro Devices, Inc. stock price forecast for 2025

On the weekly timeframe, Advanced Micro Devices shares are trading in an ascending channel and rebounded from the trendline in April 2025, which acts as support. This indicated the end of the corrective movement, during which AMD’s stock price fell by 67% from its all-time high and signals that growth could resume in the direction of the main trend. Based on AMD stock performance, possible price movements in 2025 are outlined below.

The main forecast for Advanced Micro Devices stock expects the price to test the 100 USD support level, rebound, and climb to the 130 USD resistance level. A breakout above this mark could drive further AMD stock growth, with a target at the channel’s upper line near 200 USD.

The alternative forecast for Advanced Micro Devices stock suggests a breakout below the 100 USD support level. In this case, AMD quotes could decline to 73 USD before resuming growth, with targets for recovery at the 100 USD and 130 USD resistance levels.

Analysis and forecast for Advanced Micro Devices, Inc. stock for 2025Risks of investing in Advanced Micro Devices, Inc. stock

When investing in AMD shares, it is essential to consider the following risks:

- Intense competition: AMD faces tough competition from Intel Corp. (NASDAQ: INTC) and NVIDIA, which may lower prices or accelerate the introduction of new technologies, potentially impacting AMD’s market share negatively

- Reliance on TSMC: AMD relies on TSMC to manufacture its chips. Any supply disruptions or delays in the introduction of new technology processes at TSMC (NYSE: TSM) could affect AMD’s market position

- Demand fluctuations: the PC and server market is cyclical and depends on macroeconomic conditions. A decrease in demand for devices may reduce AMD’s revenue

- Development of proprietary AI chips by consumers: large tech companies like Amazon, Google, and Microsoft are investing in the development of their semiconductors for data centres and specialised tasks. This reduces their reliance on external suppliers, including AMD. If these corporations continue to increase spending on developing their proprietary chips, it could limit AMD’s overall market, reduce its share in the data centre segment, and slow its revenue growth over the long term

- Integration of acquisitions: following the acquisitions of Xilinx and Pensando, AMD must integrate these assets into its structure effectively. Failures in this process could lead to increased costs and reduced profitability

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.