USDJPY falls below 145.00, the trend is reversing downwards

The USDJPY rate has plunged below the 145.00 level amid Moody’s downgrade of the US credit rating and anticipation of upcoming trade talks. Find out more in our analysis for 20 May 2025.

USDJPY forecast: key trading points

- Market focus: US-Japan trade negotiations to take place this Friday

- Current trend: moving downwards

- USDJPY forecast for 20 May 2025: 144.00 and 145.00

Fundamental analysis

The USDJPY pair continues to decline as investor focus shifts to the upcoming trade negotiations between Japan and the US. The third round of talks is expected to begin on Friday in Washington, with Tokyo’s chief trade negotiator Ryosei Akazawa leading the Japanese delegation.

Akazawa reiterated Japan’s commitment to securing the removal of new US tariffs under a bilateral deal, stressing that Tokyo will not accept an agreement that compromises national interests.

The main sticking point remains the proposed 25% tariff on Japanese car imports, which has faced strong opposition from Japanese politicians and lawmakers due to the automotive sector’s critical role in the national economy.

USDJPY technical analysis

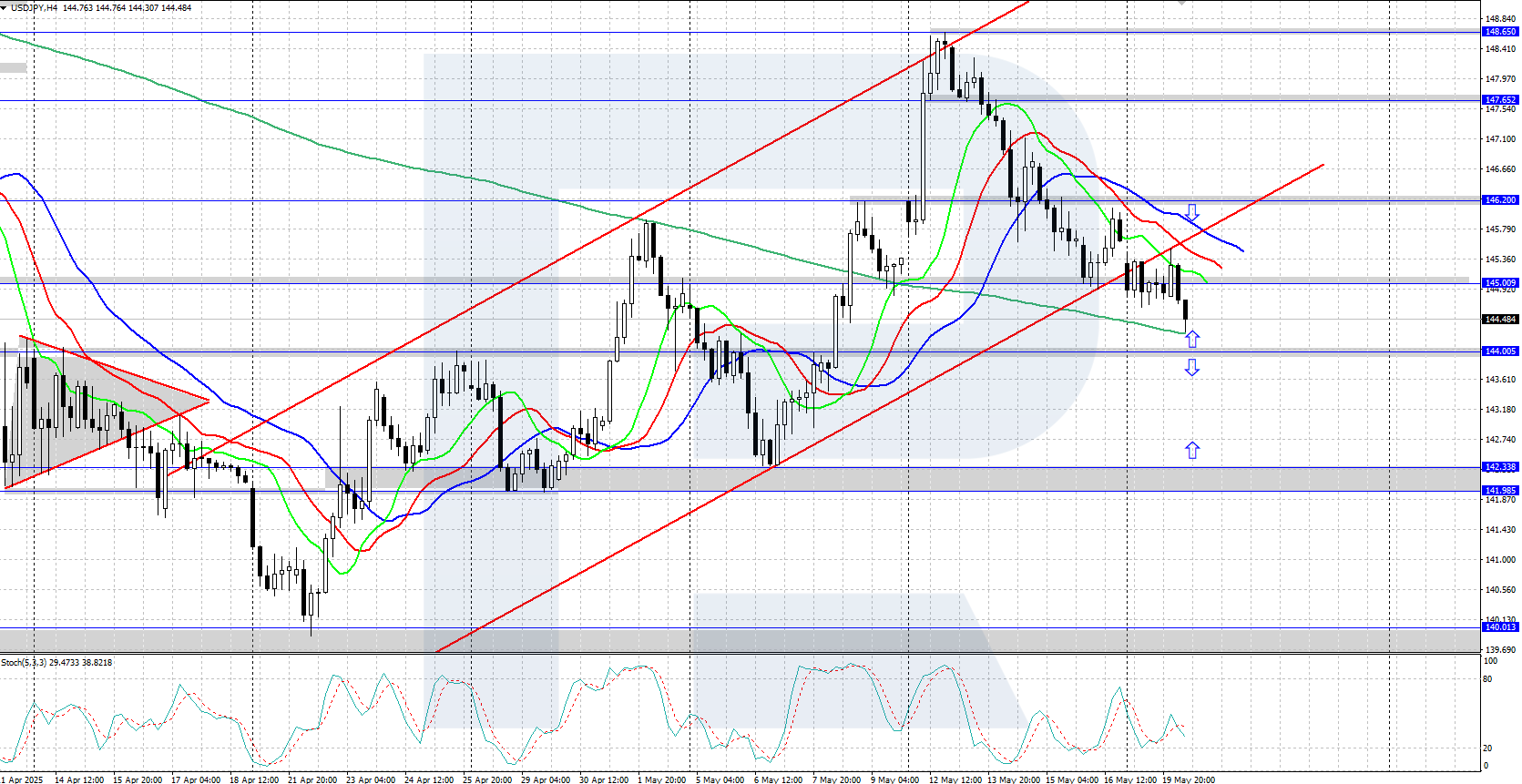

On the H4 chart, the USDJPY pair continues to decline, having broken below the key support level at 146.20 and going beyond the lower boundary of the ascending price channel. The Alligator indicator has turned down and is declining, confirming the current downtrend.

Today’s USDJPY forecast suggests the pair may continue to fall towards the 144.00 support level if bears maintain control. An upward correction could begin if bulls push the price higher and gain a foothold above 145.00, potentially targeting resistance at 146.20.

Summary

The USDJPY pair has fallen below 145.00 following Moody’s downgrade of the US credit rating. Investors are now awaiting the outcome of the upcoming trade negotiations between the US and Japan.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.