Services decline and US stagnation – double hit for USDJPY

Despite weaker economic indicators from Japan, the USDJPY forecast appears optimistic for the US dollar, with the USDJPY rate likely to advance towards 146.50. Discover more in our analysis for 19 May 2025.

USDJPY forecast: key trading points

- Japan’s Tertiary Industry Activity Index: previously at 0.5%, currently at -0.3%

- US Leading Economic Index: previously at -0.7%, projected at -0.7%

- USDJPY forecast for 19 May 2025: 146.50

Fundamental analysis

The Tertiary Industry Activity Index in Japan measures output changes in the services sector, including trade, education, healthcare, finance, and transportation. Unlike PMI, it’s based on real statistical data rather than surveys, providing a direct snapshot of monthly activity. Growth in this index signals rising business activity and domestic demand.

Fundamental analysis for 19 May 2025 takes into account that the actual index value fell to -0.3%. This drop may suggest a recession in the services sector and could pressure the Japanese yen.

The US Leading Economic Index (LEI) is a composite indicator forecasting the direction of the economy before turning points in the cycle. It combines 10 major components, such as jobless claims, new orders, consumer expectations, and financial conditions.

If the index rises, it suggests accelerating economic growth, while a decline signals a potential slowdown or even recession. For 19 May 2025, the index is expected to remain unchanged at -0.7%.

USDJPY technical analysis

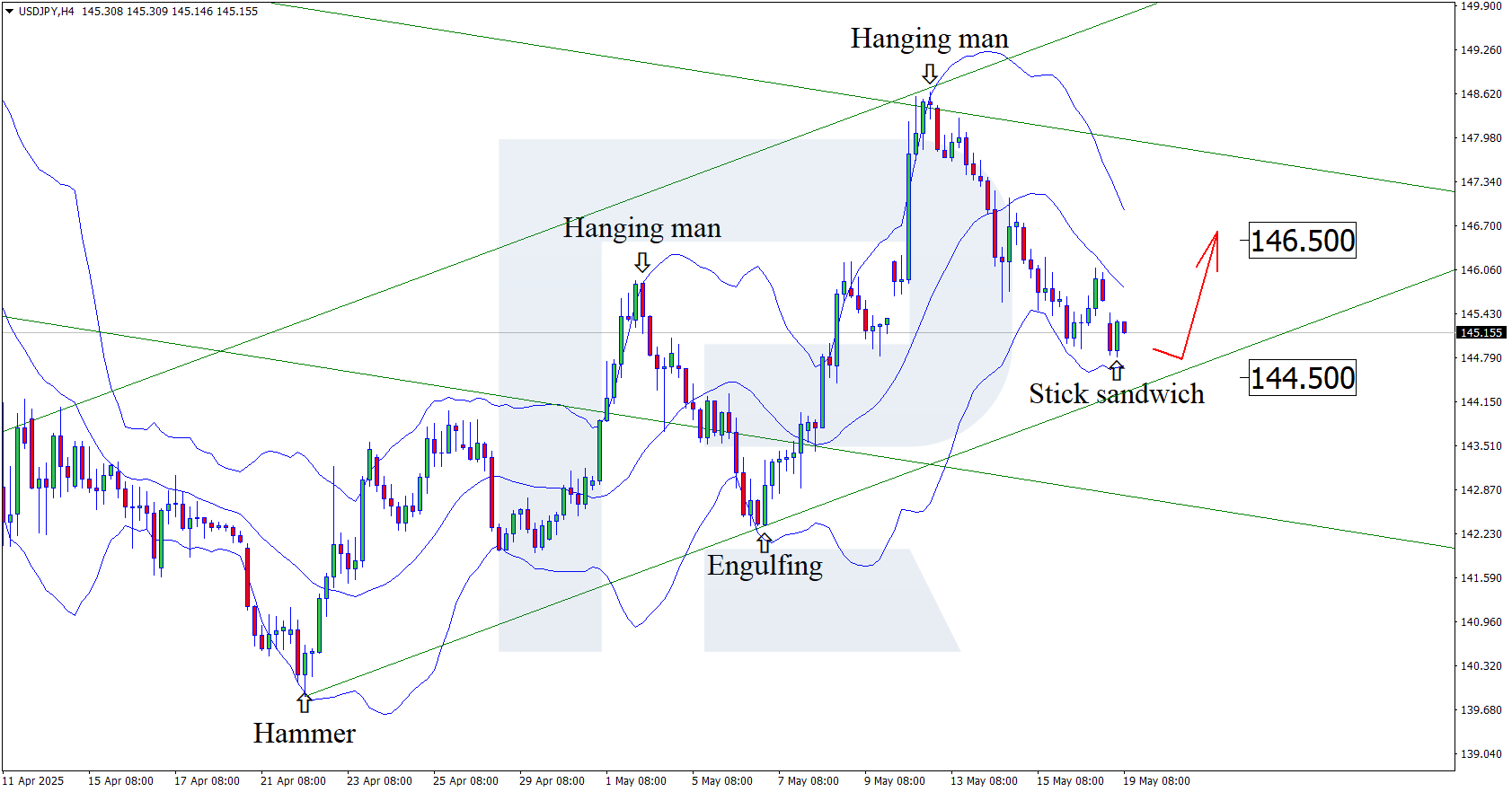

Having tested the lower Bollinger Band, the USDJPY pair formed a Sandwich reversal pattern on the H4 chart, with the price currently around 145.20. This setup may trigger an upward wave in line with the signal. The price continues to move within an ascending channel, suggesting it may reach the 146.50 level.

At the same time, today’s USDJPY forecast also considers an alternative scenario, where the price corrects towards 144.50 before a further rise.

Summary

The decline in Japan’s Tertiary Industry Activity Index, combined with USDJPY technical analysis, suggests a possible move towards the 146.50 resistance level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.