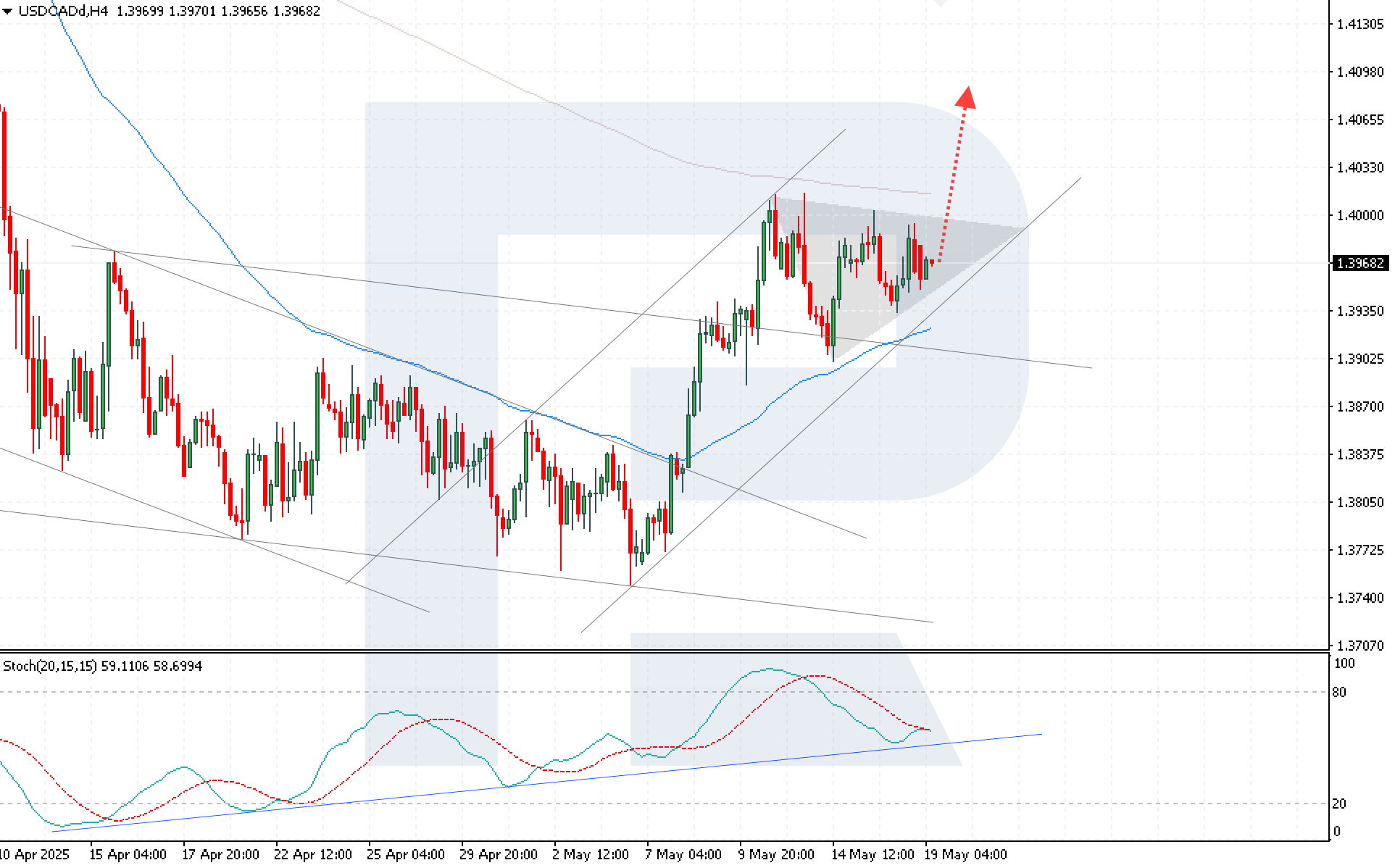

Triangle on the chart, USDCAD poised for growth

The USDCAD rate continues its correction, staying within a narrow range for six consecutive sessions. The current price is 1.3967. Find out more in our analysis for 19 May 2025.

USDCAD forecast: key trading points

- Moody’s Ratings downgraded the US credit rating due to a growing budget deficit

- A string of disappointing US economic data has strengthened expectations of two Federal Reserve rate cuts

- USDCAD forecast for 19 May 2025: 1.4095

Fundamental analysis

The USDCAD rate is edging lower, still trading within a Triangle pattern, which signals market indecision. Nevertheless, buyers remain active, and a breakout above 1.4005 could give the USDCAD outlook a distinctly bullish tone.

The US dollar came under additional pressure after Moody’s Ratings downgraded the US government’s credit rating, stripping it of its highest grade. The downgrade was driven by a widening budget deficit and rising interest payments on the debt.

The US dollar weakened further due to a series of disappointing US economic reports, which increased expectations that the Federal Reserve might cut rates twice before the end of the year. Notably, the Consumer Confidence Index unexpectedly dropped to 50.8 in May from 52.2 in April, marking the fifth consecutive decline and hitting its lowest level since June 2022 – the second lowest reading in recorded history.

USDCAD technical analysis

The USDCAD rate remains within the Triangle pattern. Today’s USDCAD forecast suggests a breakout above the pattern’s upper boundary and continued growth towards 1.4095.

Technical indicators support the bullish scenario, with the price holding above the EMA-65, indicating strong buying pressure, and the Stochastic Oscillator rebounding from the ascending support line.

A consolidation above 1.4005 would confirm the bullish breakout and open the way to the next target at 1.4095.

Summary

The US credit rating downgrade and weak economic data add to pressure on the US dollar. USDCAD technical analysis points to a potential breakout above the Triangle pattern’s upper boundary and a move towards 1.4095.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.