GBPUSD storms highs, rising prices boost bullish sentiment

The British pound continues to strengthen, with the GBPUSD rate soon likely to reach the 1.3500 level. Discover more in our analysis for 21 May 2025.

GBPUSD forecast: key trading points

- UK Consumer Price Index (CPI): previously at 2.6%, projected at 3.3%

- The GBPUSD pair is testing the April high

- GBPUSD forecast for 21 May 2025: 1.3500 and 1.3390

Fundamental analysis

Fundamental analysis for 21 May 2025 takes into account that the GBPUSD rate continues its upward trajectory, aiming to retest April’s high.

The UK CPI reflects changes in the prices of goods and services, offering insights into consumer trends and economic stagnation. A reading above expectations typically supports the national currency.

The forecast for April 2025 suggests a rise in the CPI to 3.3%, up from 2.6% previously. This increase would further support the British pound.

Today’s outlook for GBPUSD remains favourable for the pound, with the pair having strong potential to reach this year’s highs and continue its upward momentum.

GBPUSD technical analysis

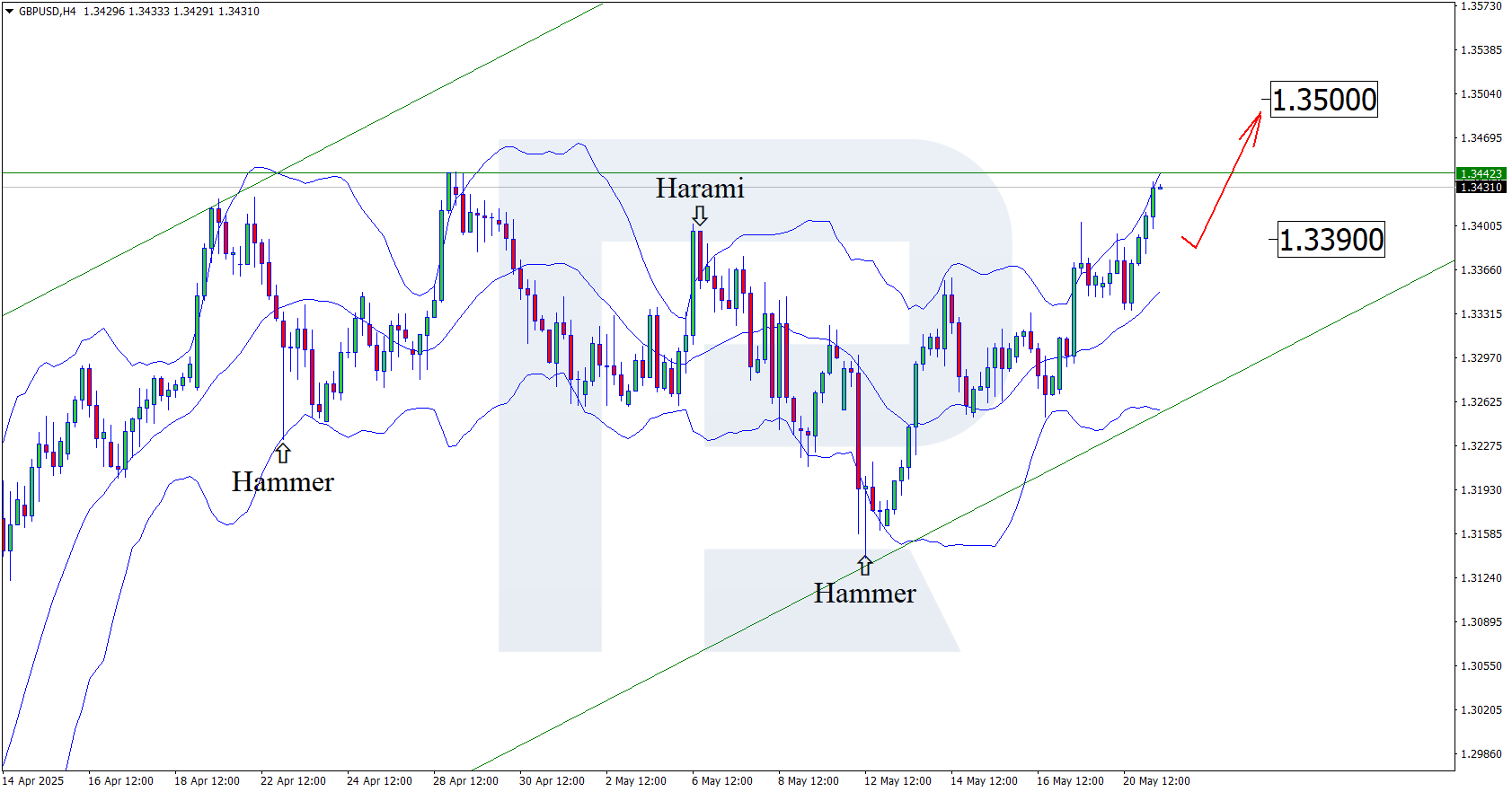

Having tested the lower Bollinger Band, the GBPUSD pair formed a Hammer reversal pattern on the H4 chart. The pair is now developing an upward wave in response to this signal. Since the GBPUSD pair remains within an ascending channel and given fundamental data from the UK and the US, the bullish wave is expected to continue.

The immediate upside target is 1.3500. A breakout above the resistance level would open the door to further bullish momentum.

The GBPUSD forecast also considers an alternative scenario, where the price corrects towards 1.3390 before rising.

Summary

Positive forecasts for the British pound, together with GBPUSD technical analysis, suggest growth towards the 1.3500 resistance area.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.