Europe revives, US weakens – EURUSD on the verge of a surge

Amid upbeat euro forecasts, the EURUSD rate may maintain its upward momentum, with the next upside target at 1.1400. Find more details in our analysis for 22 May 2025.

EURUSD forecast: key trading points

- Eurozone manufacturing PMI: previously at 49.0, projected at 49.2

- US manufacturing PMI: previously at 50.2, projected at 49.9

- EURUSD forecast for 22 May 2025: 1.1400 and 1.1290

Fundamental analysis

The manufacturing Purchasing Managers’ Index (PMI) measures the activity of purchasing managers in the industrial sector. It reflects the state and dynamics of manufacturing processes within a country. Since purchasing managers are the first to receive information about the performance of their companies, PMI is a vital gauge of the broader economic outlook. A reading above 50.0 indicates growth, while a lower figure suggests contraction.

The forecast for 22 May 2025 expects the eurozone manufacturing PMI to rise slightly to 49.2. The increase is not too big, with the reading still below the expansion threshold of 50.0.

Fundamental analysis for 22 May 2025 takes into account that the US manufacturing PMI due today is projected to decline to 49.9. A reading below 50.0 would further pressure the US dollar.

The EURUSD outlook remains bullish, with the euro continuing to gain ground against the US dollar.

EURUSD technical analysis

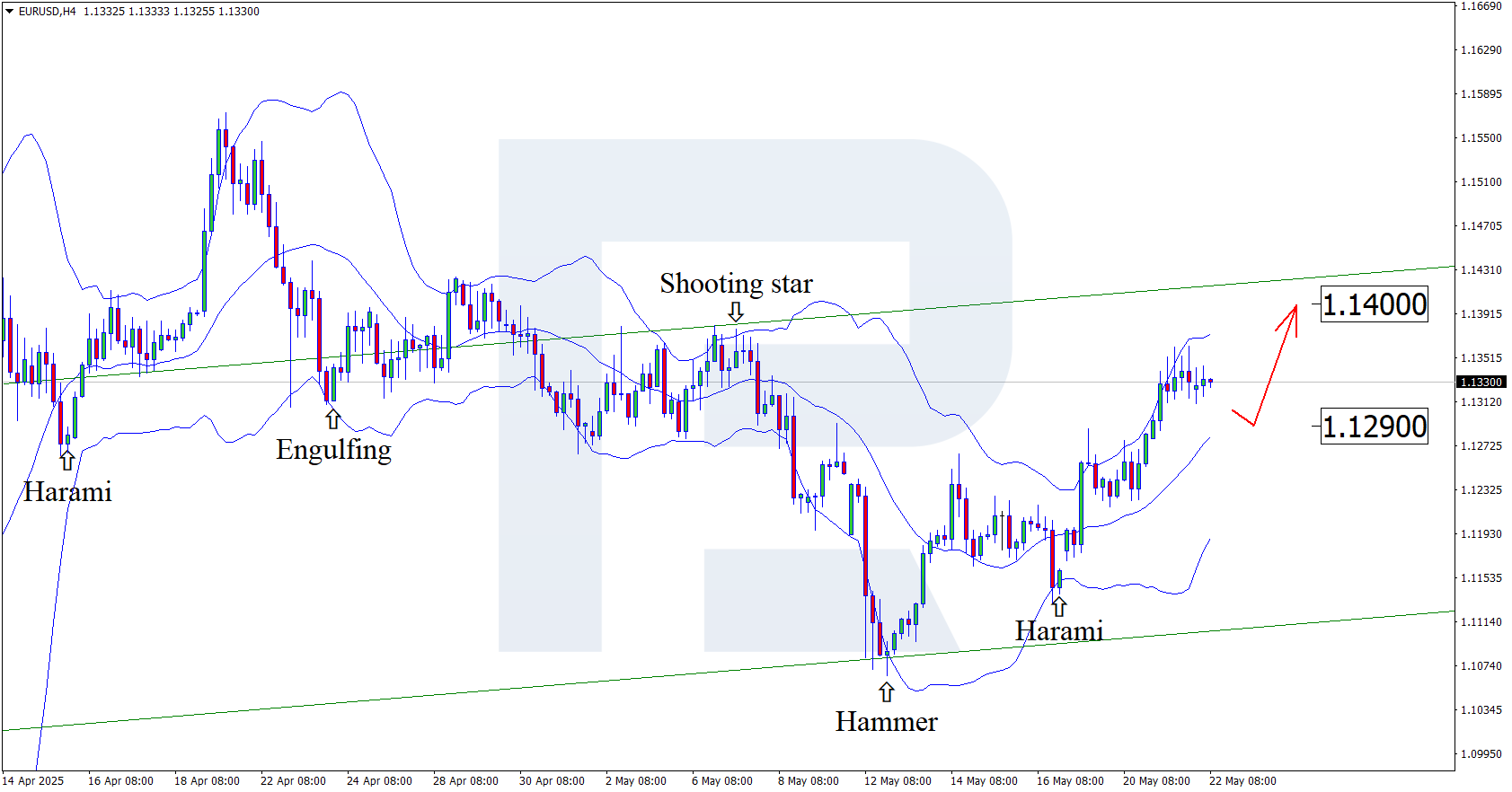

On the H4 chart, the EURUSD pair has formed a Harami reversal pattern near the lower Bollinger Band. The pair is currently extending its upward wave based on this signal. As the price remains within the ascending channel, further growth towards the nearest resistance at 1.1400 is likely. A breakout above this level would signal a continuation of the bullish trend.

However, the EURUSD pair could correct towards 1.1290 and gain upward momentum after testing the support level.

Summary

The EURUSD outlook for today appears rather optimistic, with a rise in eurozone PMI and a dip in US PMI favouring the euro. Together with technical analysis, this suggests further growth towards 1.1400 USD following a correction.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.