EURUSD rises for the third day: confidence in the US dollar hits zero

The EURUSD pair is hovering around 1.1323 midweek. Investors reacted nervously to the failure of Trump’s tax initiative. Find out more in our analysis for 21 May 2025.

EURUSD forecast: key trading points

- The EURUSD pair is rising for the third consecutive day as the US dollar weakens following the collapse of Trump’s tax bill

- Fed policymakers highlight growing economic risks in the US, fuelling market concern

- EURUSD forecast for 21 May 2025: 1.1349 and 1.1384

Fundamental analysis

The EURUSD rate climbed to 1.1323 on Wednesday, marking the third consecutive day of gains for the main currency pair. The US dollar is under pressure due to fiscal policy uncertainty and growing fears about the health of the US economy.

The rejection of Donald Trump’s tax reform proposal dealt a significant blow to the US dollar as the president failed to secure enough Republican support. The failure has intensified doubts over fiscal stability, especially in light of Moody’s recent downgrade of the US credit rating, citing rising public debt and budget deficits.

Federal Reserve officials have also voiced concern about Trump’s trade policies. St. Louis Fed President Alberto Musalem warned of a weakening labour market and rising prices, while Cleveland Fed President Beth Hammack flagged the risks of stagflation.

The EURUSD outlook is favourable.

EURUSD technical analysis

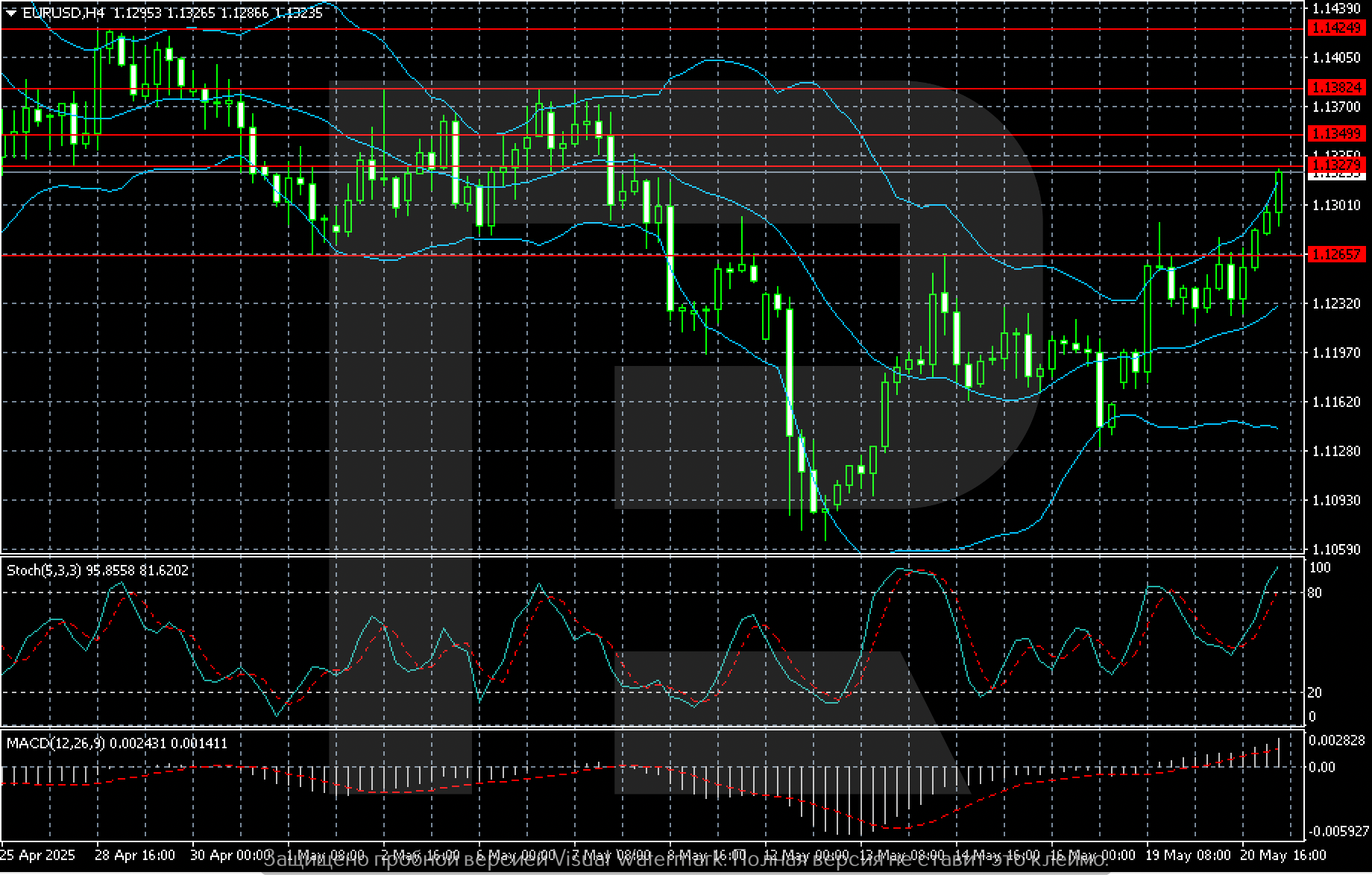

On the EURUSD H4 chart, conditions suggest a continued upward wave towards 1.1384, provided the pair breaks above the interim resistance at 1.1349 and consolidates above it. The current bullish wave appears stable, with pauses only in the form of consolidation rather than reversals.

Summary

The EURUSD pair continues to rise as markets turn away from the US dollar. Concerns about the US economic outlook are mounting, especially following the failure of Trump’s tax bill. The EURUSD forecast for today, 21 May 2025, anticipates continued growth towards 1.1384 via 1.1349.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.