Gold (XAUUSD) at two-week high: US budget prompts risk-off shift

Gold (XAUUSD) prices have climbed to 3,338 USD as investors are seeking safe-haven assets amid concerns over US fiscal policy. Discover more in our analysis for 22 May 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) prices have been rising for four consecutive trading sessions with no signs of slowing

- Demand for safe-haven assets grows amid mounting uncertainty in the US and the Middle East

- XAUUSD forecast for 22 May 2025: 3,346 and 3,358

Fundamental analysis

Gold (XAUUSD) has posted its fourth consecutive daily gain, reaching 3,338 USD per troy ounce. Investors are increasingly seeking reliable assets amid growing concerns about the US fiscal outlook.

Risk appetite declined following the release of a proposed US federal budget, which could further widen the already large deficit. Additional pressure came from Moody’s recent US credit rating downgrade, citing rising debt levels, alongside a cautious economic outlook from the Federal Reserve.

Geopolitical uncertainty also supports gold’s appeal, with ongoing tensions in the Middle East adding to market anxiety.

According to Chinese customs data, gold imports surged to an 11-month high in April, reaching 127.5 thousand tonnes (+73% m/m). The jump reflects strong demand and additional import quotas granted by the central bank amid rising trade tensions with the US.

The gold (XAUUSD) outlook is positive.

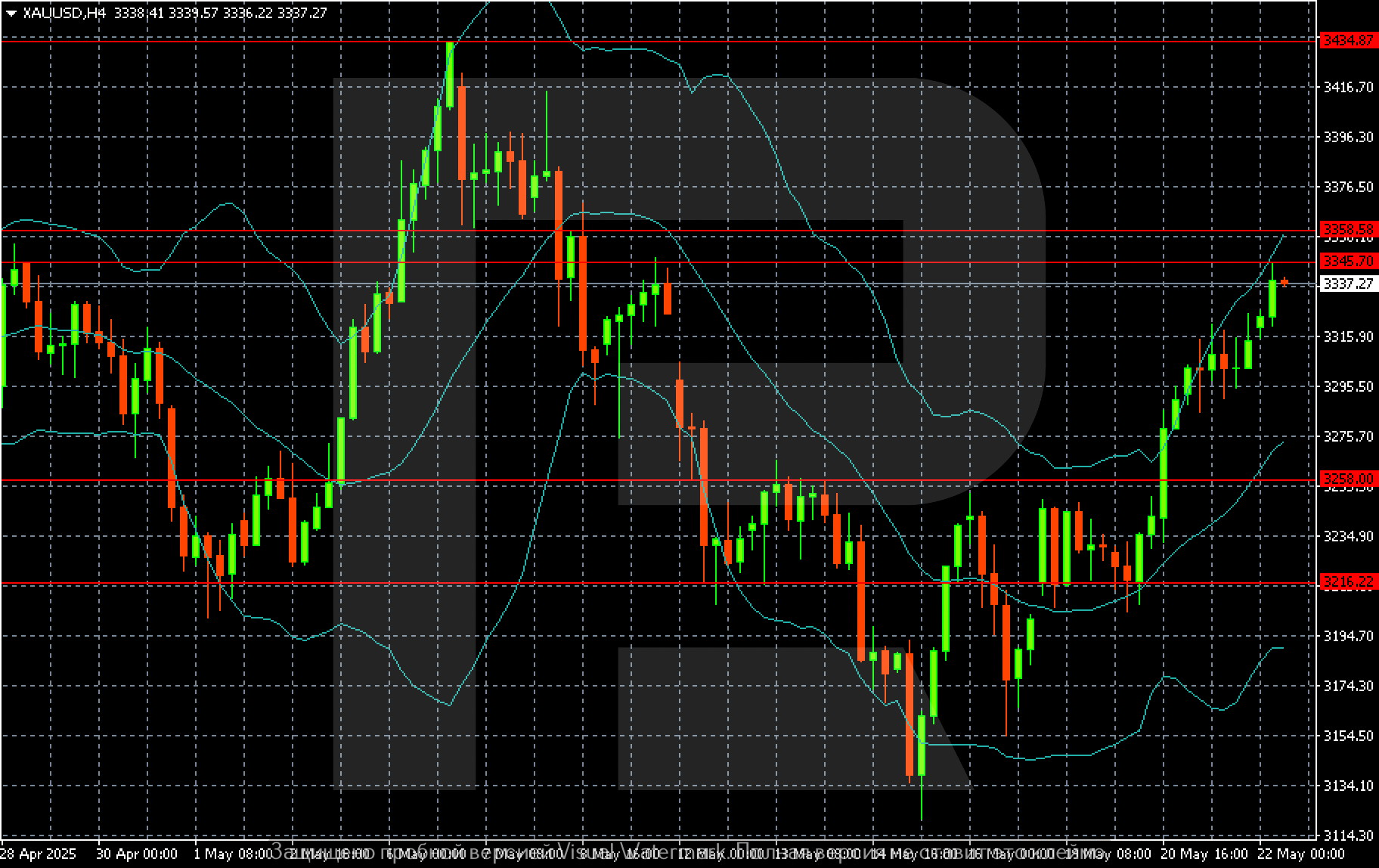

XAUUSD technical analysis

On the H4 chart, gold (XAUUSD) shows signs of a short-term consolidation around the 3,335 level. Subsequently, the market may resume its uptrend towards 3,358, provided it gains a foothold above 3,346.

Summary

Gold (XAUUSD) quotes have reached a two-week high as market tension grows around the proposed US federal budget. The XAUUSD forecast for today, 22 May 2025, suggests a move higher towards 3,358 following a brief pause.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.