Gold (XAUUSD) surges above 3,300 USD – will the rally continue?

XAUUSD quotes closed Tuesday with a strong gain of over 2% and today climbed above the 3,300 USD mark, capitalising on the current US dollar weakness. Discover more in our analysis for 21 May 2025.

XAUUSD forecast: key trading points

- Market focus: gold rises amid reports of a possible escalation in the Middle East conflict

- Current trend: strong upward momentum is underway

- XAUUSD forecast for 21 May 2025: 3,350 and 3,250

Fundamental analysis

Pressure on the US dollar intensified after President Donald Trump failed to convince Republicans to support his sweeping tax reform bill, raising questions about fiscal stability. This followed Moody’s recent downgrade of the US sovereign credit rating due to rising debt and a widening deficit.

Demand for gold and other safe-haven assets increased after reports emerged that Israel plans to strike Iranian nuclear facilities. The conflict in the Middle East could sharply escalate as such an attack could provoke retaliation from Iran.

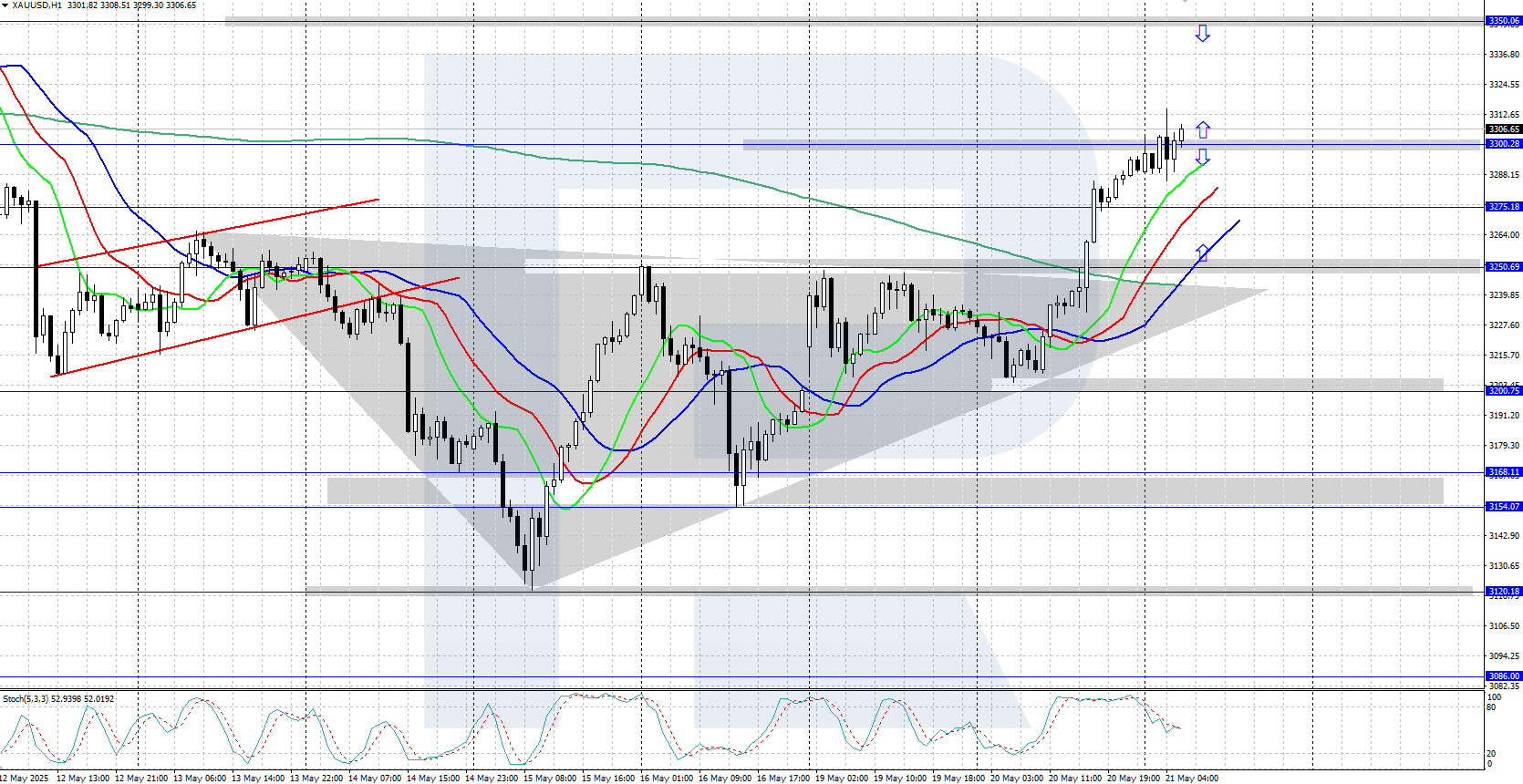

XAUUSD technical analysis

Gold is showing strong upward momentum, having reversed from daily support at 3,120 USD. The Alligator indicator is trending higher, confirming the ongoing bullish dynamics. In the near term, the rally in gold may continue.

The short-term XAUUSD price forecast suggests that if bulls maintain control, prices could climb towards 3,350 USD. However, if bears manage to push prices below 3,300 USD and gain a foothold there, a correction towards 3,250 USD may follow.

Summary

XAUUSD prices are rising sharply, breaking above the 3,300 USD mark. Gold is supported by US dollar weakness and rising tensions in the Middle East.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.