Gold (XAUUSD) in positive territory: the strongest weekly decline in six months now behind

Gold (XAUUSD) prices are hovering around 3,215 USD. Demand for safe-haven assets is rising again following news related to the US credit rating. Find more details in our analysis for 19 May 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) is rebounding after the largest weekly decline since November 2024

- Risk-off sentiment grows following a downgrade of the US credit rating

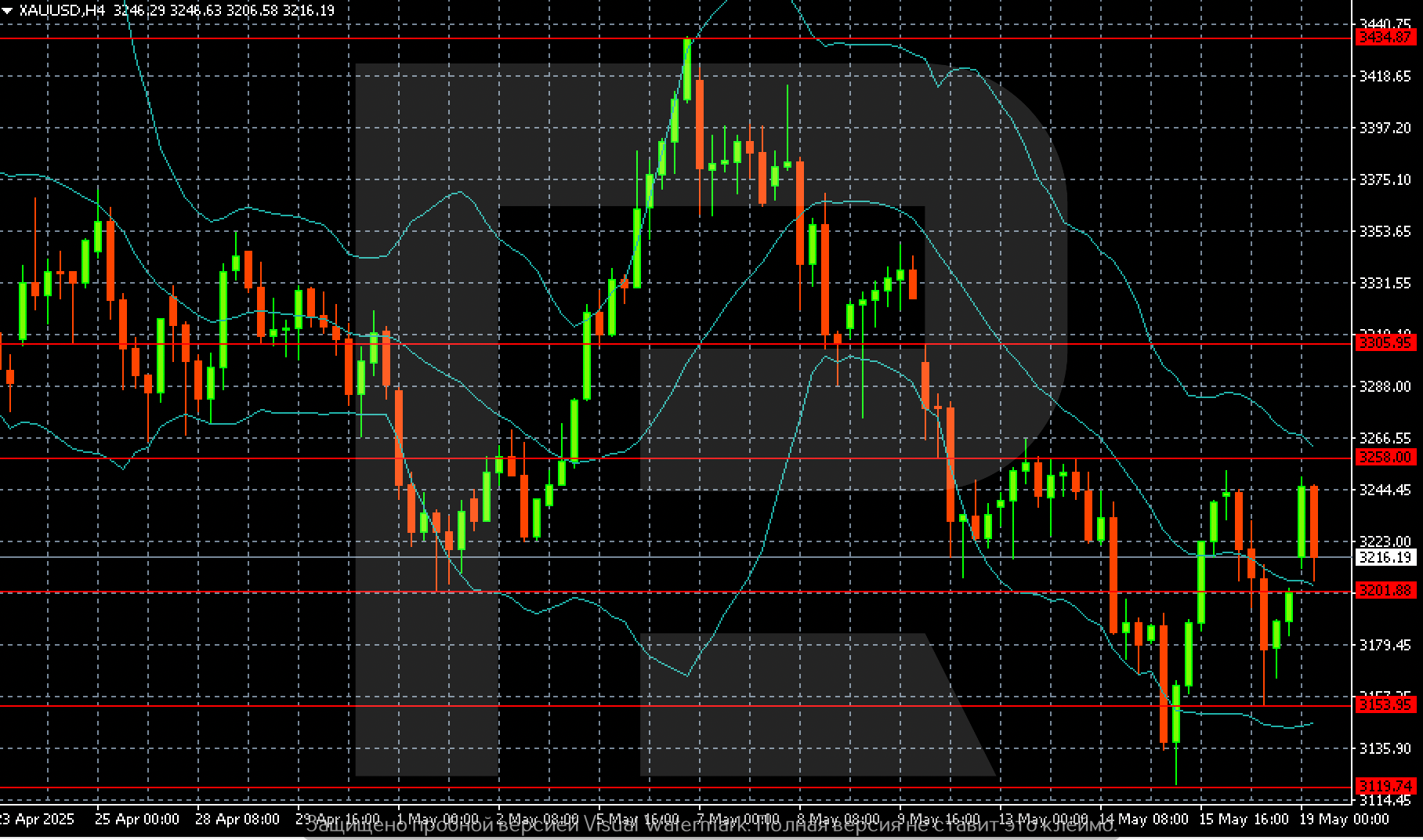

- XAUUSD forecast for 19 May 2025: 3,201 and 3,153

Fundamental analysis

Gold (XAUUSD) prices consolidated around 3,215 USD on Monday. Last week ended with the steepest drop in the precious metal’s value in six months.

Safe-haven demand increased amid growing concerns over the US economic outlook and budget deficit.

Last Friday, credit rating agency Moody’s downgraded the US government's credit rating, stripping it of its latest AAA grade. The downgrade was driven by large fiscal deficits and rising interest expenses.

Gold quotes fell by more than 3% last week, pressured by renewed risk appetite after the US and China reached a deal. The two largest economies agreed to a 90-day suspension of most tariffs introduced since early April, easing fears of a global recession.

The Gold (XAUUSD) forecast is cautious.

XAUUSD technical analysis

On the H4 chart, Gold (XAUUSD) may attempt a move towards 3,258 if it can hold near current levels. However, a more likely scenario suggests a retest of 3,201, followed by a move towards 3,153 and 3,119, respectively.

Summary

Gold (XAUUSD) prices find support for recovery and stabilisation after last week’s decline. The Gold (XAUUSD) forecast for today, 19 May 2025, anticipates a renewed move lower towards 3,201 and 3,153.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.